Annuity calculator compounded monthly

Calculator of Annuity Monthly Payments. For example in case of an account with a starting principal of 100000 by making an annual additions of.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

Calculating Present And Future Value Of Annuities

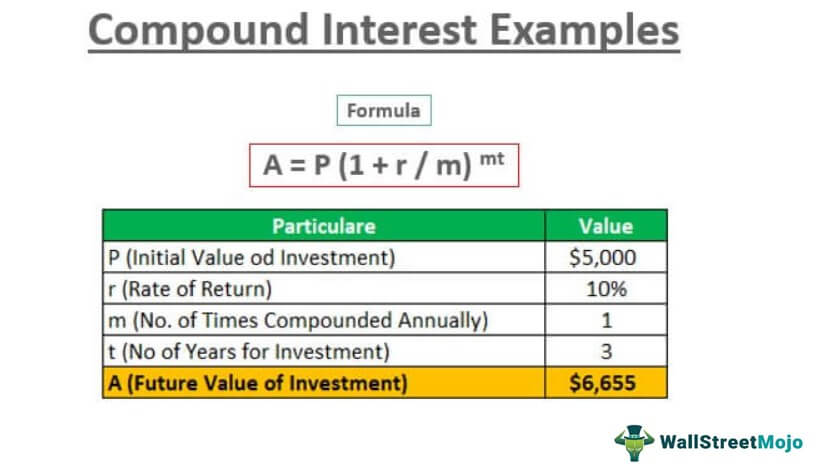

The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100.

. Compounding frequency which explains how frequent the interest gets compounded. We also provide an Annuity calculator with a downloadable excel template. To get the best result from an annuity calculator it helps to know the average annuity rates for the type of annuity you plan to buy.

This solver can calculate monthly or yearly fixed payments you will receive over a period of time for a deposited amount present value of annuity and problems in which you deposit money. Its algorithm is based on the standard compound interest and annuity formulas. With this calculator you can find several things.

Thus the interest of the second year would come out to. To calculate the compounded annually formula you will need to know the following information. Formula for Calculat of Annuity.

The algorithm behind this future value of annuity calculator applies the. In this case you lend to the bank at the notified interest rates contrary to taking a loan from the bank. In case on annuity this is set to be Annually but when is the case it can be changed to one of the other.

In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company to an investor in a stream of cash flows over a period of time typically as a means of. An annuity is an investment that provides a series of payments in exchange for an initial lump sum. Annuity Calculator for calculating the monthly paymentsdeposits based on quarterly compounding.

There are several variables that go into calculating annuity. Here we discuss how to calculate Annuity along with practical examples. The number of years the investment will be.

Annuity Calculator - Calculate Annuity Payments. 110 10 1. The principal amount invested.

This is a guide to Annuity Formula. Calculate the present value of an annuity due ordinary annuity growing annuities and annuities in perpetuity with optional compounding and payment frequency. An annuity fund is an investment portfolio that provides a return on the funds premium that you pay into an annuityWhen the insurance company invests your money into.

The payment that would deplete the fund. An annuity running over 20 years with a starting principal of 25000000 and growth rate of 8 would pay approximately 209110 per. The calculation for annuity deposits are similar to that of loan repayments.

Of periods by default will be given in months. For example if the interest rate is compounded monthly then the No.

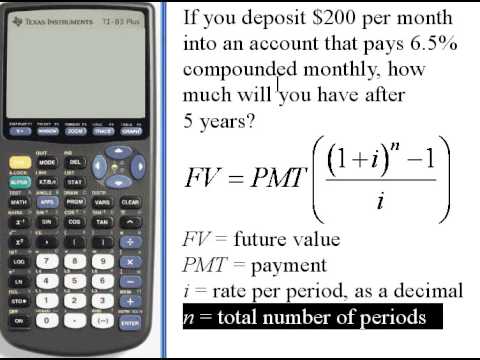

Calculating Present Value Of An Annuity Ti 83 84 141 35 Youtube Annuity Calculator Investing

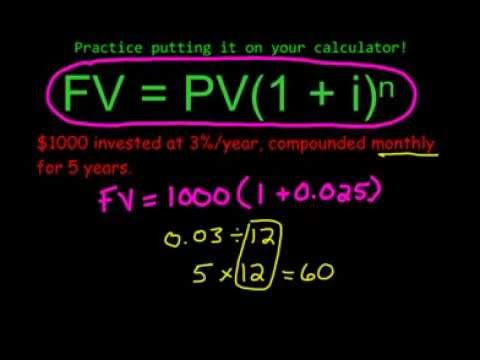

Compound Interest Future Value Youtube

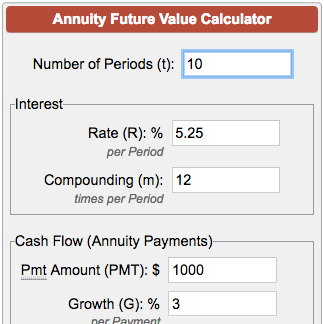

Future Value Of Annuity Calculator

Future Value Of An Ordinary Annuity With Compounding Sharp El 738 Financial Calculator Youtube

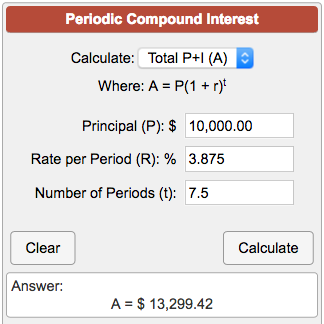

Periodic Compound Interest Calculator

Future Value Annuity Calculator Calculate Fv Of Equal Cash Flows

Future Value Of Annuity Calculator

Calculating Future Value Of An Annuity Ti 83 84 141 33 Youtube

Mathematics Of Compounding Accountingcoach

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities6-f3e0ae90db8b4a5398e3fcabd0538a92.png)

Calculating Present And Future Value Of Annuities

Present Value Of An Annuity Calculator Date Flexibility

Compound Interest Calculator Daily Monthly Quarterly Annual

Future Value Of Annuity Calculator

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Examples Annually Monthly Quarterly

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

Calculating Present And Future Value Of Annuities

Present Value With Interest Compounded Monthly Youtube